Have you underclaimed your expenses?

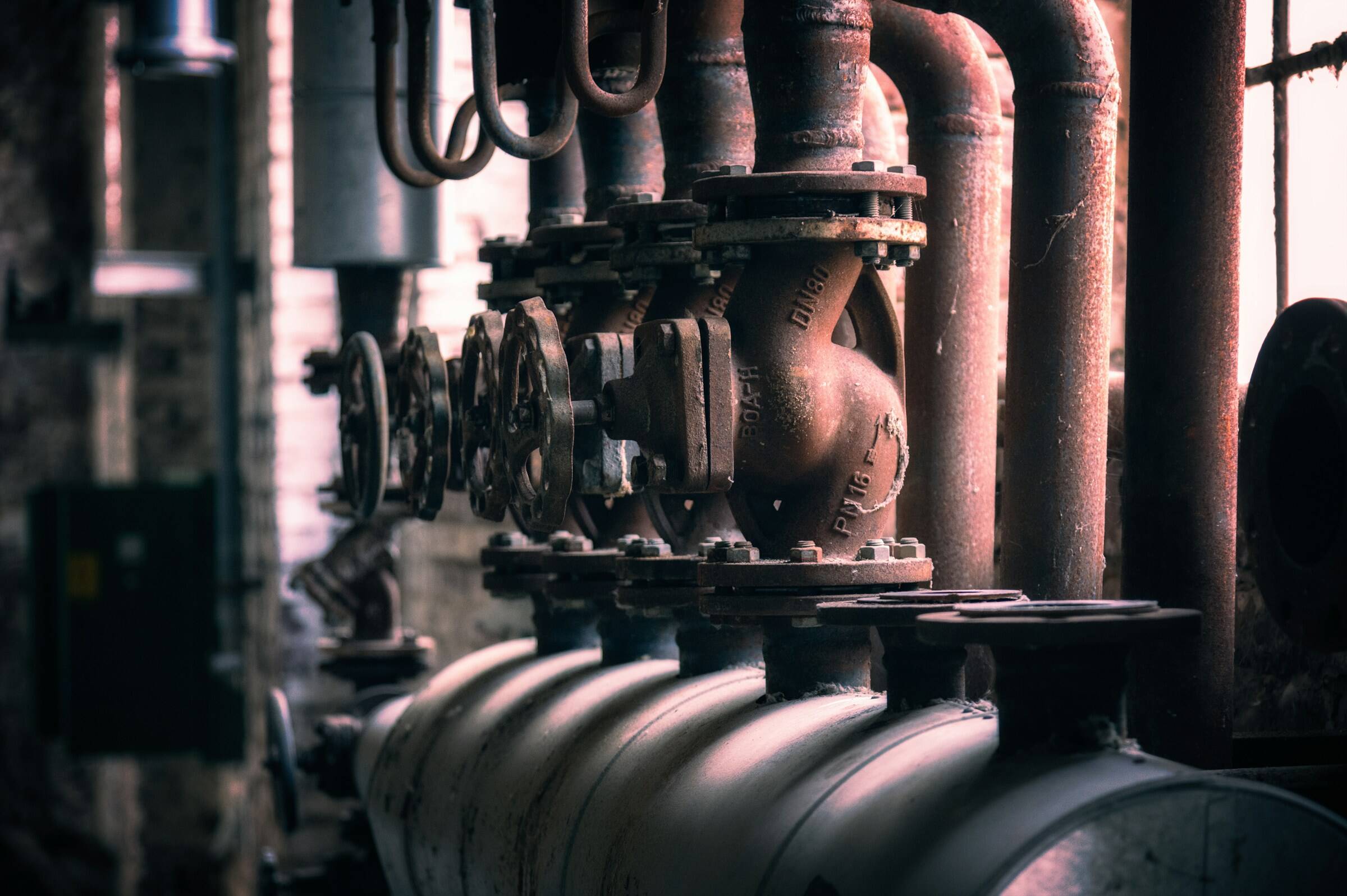

In 2022/23, HMRC sent a nudge letter to taxpayers that included a statement saying that upgrading a boiler wouldn’t be a deductible expense for tax purposes, i.e. as a deduction from rental income. It is now writing to individuals admitting that this was wrong. What action do you need to take?

The initial letter was a prompt to check property letting expenses that had been claimed on the 2021/22 tax return. It contained the statement that “upgrading a central heating boiler from an older, less efficient model’ is an example of an expense you can’t claim tax relief for”. Essentially, the implication is that an improvement is not a repair, and so is a capital expense. HMRC has now owned up to the mistake, and has confirmed that such an expense would generally be accepted as a repair.

If you haven’t claimed for the cost of a replacement boiler, you could be owed a tax refund. Check your returns and if you have underclaimed your expenses, take action accordingly. If it is for 2022/23, you can simply amend the return. However, if it’s your 2021/22 return that is affected, you should contact the specialist team by email at responseteam5@hmrc.gov.uk.

Related Topics

-

HMRC has withdrawn Form 652. How should you notify VAT errors going forward?

-

Can paying interest to your company save tax?

You recently borrowed a substantial sum of money from your company rather than take extra salary or dividends. Your bookkeeper says it might be more tax efficient if your company charged you interest. This sounds counter-intuitive but is it correct?

-

Reverse charge and end user rules: opportunity?

If you sell construction services to other builders, you need to consider the domestic reverse charge rules. You must apply these where your customer is an end user. How might this create a cash-flow advantage?

This website uses both its own and third-party cookies to analyze our services and navigation on our website in order to improve its contents (analytical purposes: measure visits and sources of web traffic). The legal basis is the consent of the user, except in the case of basic cookies, which are essential to navigate this website.

This website uses both its own and third-party cookies to analyze our services and navigation on our website in order to improve its contents (analytical purposes: measure visits and sources of web traffic). The legal basis is the consent of the user, except in the case of basic cookies, which are essential to navigate this website.